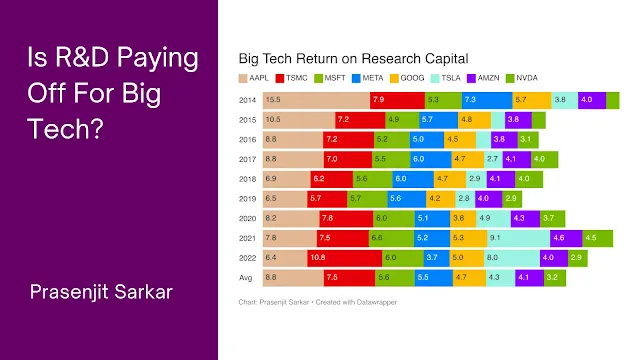

Is R&D Paying Off For Big Tech?

Current year gross profit. Divided by prior year R&D spending. As reported in the income statement. Excludes R&D capitalised on the balance sheet. If any.

Assumes a 12-month gestation. For research to begin paying for itself. Hence "prior year".

Even though ...

R&D is always a balance. Between short-term and long-term. Between ongoing expenses and capital investments.

After all, research budgets are for facilities. Building labs and apparatus.

And for infrastructure. Procuring software and services.

And for talent. Hiring scientists and technicians.

What's more ...

Not all R&D is equally productive. Ultimately, even the Big Tech titans are in different businesses.

For instance ...

Apple's making apps, games, spatial photos and 3D videos come to life. In our physical space. Through Vision Pro headsets. Their next game changer.

TSMC's busy scaling 3nm semiconductor chip production. To power 5G smartphones and high-performance computers.

Meta's creating a new online world. Where people will work, play, explore and connect socially in immersive 3D. Using virtual and augmented reality.

Not all R&D is easy to quantify ...

Some innovations lead to new product launches. That disrupt the industry.

Some result in patents and discoveries. Protecting companies from competition.

Some reduce operating costs. Or make processes more efficient. Or enhance product quality.

And so on ...

Nothing happens overnight.

So we've taken the last nine fiscal years. Apple's, Microsoft's and Nvidia's fiscal years are Oct-Sep, Jul-Jun and Feb-Jan. TSMC, Meta, Alphabet, Tesla and Amazon follow Jan-Dec.

On average, over this period, Apple tops the list. With 8.81 dollars of gross profit earned. Per dollar spent on R&D.

Followed by TSMC, Microsoft, Meta, Alphabet, Tesla and Amazon.

With Nvidia's RORC as the lowest. 3.21 dollars gross profit. Per dollar R&D. Guess their best days are ahead.

2020 and 2021, the pandemic years, were a windfall for TSMC, Microsoft, Tesla, Amazon and Nvidia. Their RORC soared.

Of these, Tesla and TSMC sustained their good run in 2022. RORC hitting new highs.

While Apple and Meta ended 2022 with their lowest-ever RORC.

Together, though, these are the eight tech companies with the highest market caps. Going into 2024.

Thanks to a new paradigm. Called AI. Pervading every industry. With new use cases every day.

For example ...

Amazon's using deep learning. To forecast holiday demand. Mobile robots with machine vision. To fetch inventory and sort parcels. Learning models. To plan last mile delivery routes. Generative AI. To match customer addresses.

Google's rolling out Search Generative Experience, Circle to Search and AI-powered multisearch. Making search natural and intuitive. And shopping easier and faster.

Nvidia's designing powerful DPUs for data centres and the cloud. Empowering big data analysts. To predict the next hailstorm. Develop the next wonder drug.

Tesla's using neural networks to gather real-time visual data for its learning model. Generating 3D outputs with road layouts, obstacles and traffic patterns. To bring driverless operation to the masses.

Microsoft Copilot's reshaping how we navigate the web. Helping consumers and businesses work smarter. And to get more creative. With a simple right-click.

Clearly, technology never sleeps.

With all these, though, Big Tech R&D spending has been surging.

To illustrate, Meta spent 27% of its 2023 Q3 sales on R&D! Alphabet and Amazon 15% each!

Is this tempting fortune?

Or will gross profit keep pace? Sooner than later?

Is the question "when" or "whether"?

Let us know your thoughts. In the comments below.

Until next time. :)

Comments

Post a Comment